📈 Local Market Reality

Homes in Wilmington, Leland, Hampstead, and surrounding coastal communities continue to attract:

-

Relocating buyers

-

Military families (Camp Lejeune)

-

Second-home and coastal lifestyle buyers

This means multiple offers are still common — especially for well-priced homes.

🏡 Sellers Expect Pre-Approval

Most listing agents in Southeastern NC advise sellers to prioritize offers with:

-

Verified pre-approval letters

-

Strong financing terms

-

Shorter closing timelines

A pre-qualified buyer may be passed over, even with a similar price.

How Pre-Approval Gives Wilmington Home Buyers a Competitive Edge

Being pre-approved allows you to:

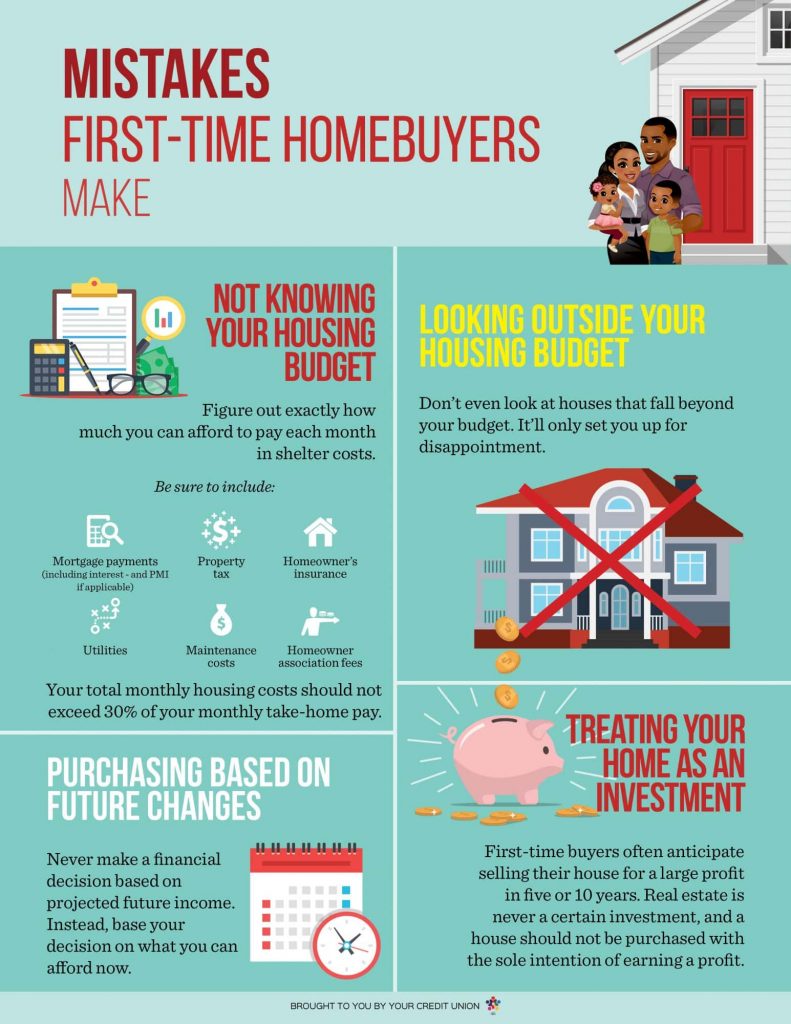

✅ Know your real budget

Avoid falling in love with homes outside your actual buying power.

✅ Make fast, confident offers

Critical when homes hit the market mid-week or sell within days.

✅ Strengthen negotiations

Sellers are more willing to accept offers with fewer financing uncertainties.

✅ Close faster

Much of underwriting is already completed, reducing last-minute surprises.

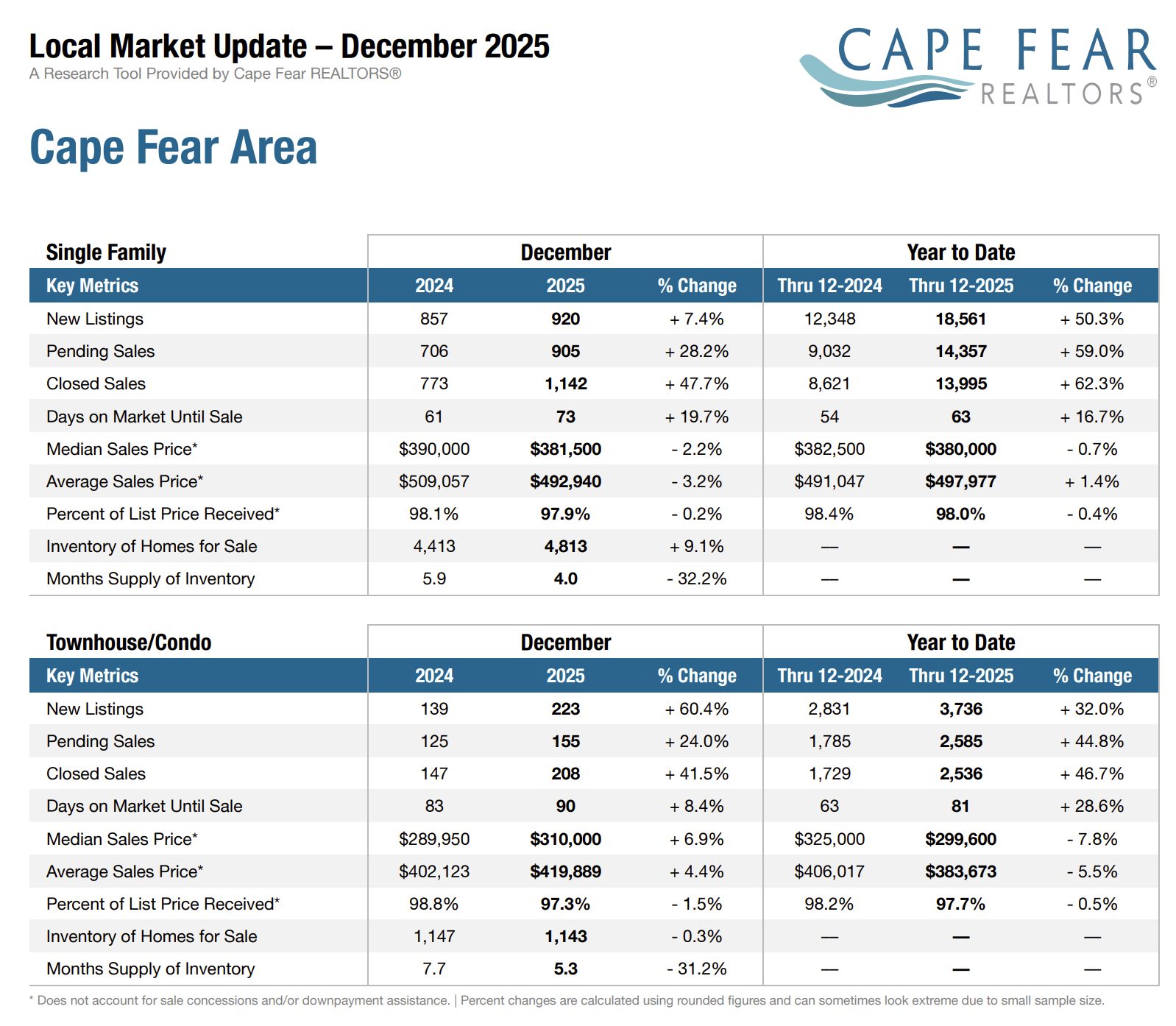

Current Mortgage & Buyer Trends Buyers Should Know (2026 Outlook)

Lenders are scrutinizing:

-

Credit scores

-

Debt-to-income ratios

-

Employment stability

Pre-approval identifies potential issues before you write an offer.

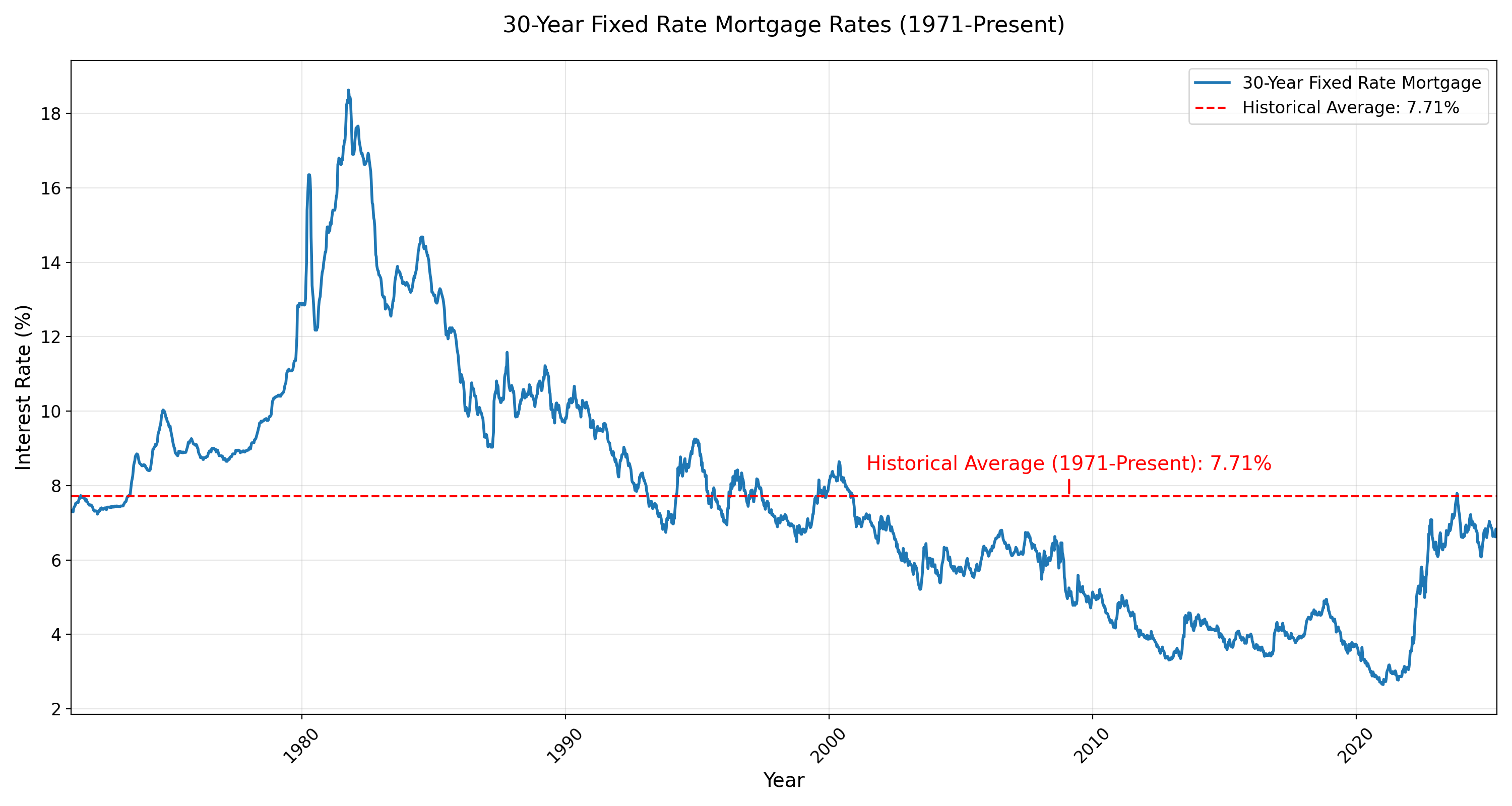

📉 Interest Rate Volatility

Rates can change weekly. Pre-approval lets buyers:

-

Track affordability accurately

-

Lock rates when advantageous

-

Adjust strategy without delay

🕒 Speed Matters

Homes priced correctly in Wilmington often receive offers within days — buyers without pre-approval are often too slow to compete.

Common Mortgage Pitfalls to Avoid When Contacting Lenders

❌ Mistake #1: Relying Only on Pre-Qualification

Pre-qualification letters carry little weight with sellers and can give a false sense of readiness.

❌ Mistake #2: Opening New Credit Accounts

New cars, furniture, or credit cards can change your debt-to-income ratio and derail approval.

❌ Mistake #3: Waiting Too Long to Get Approved

Pre-approvals typically last 60–90 days. Letting them expire can cause delays or financing changes.

❌ Mistake #4: Not Comparing Lenders Properly

Rate shopping should happen within a short window so credit checks are grouped together — protecting your credit score.

Why Buyers in Wilmington NC Should Start With Pre-Approval

Whether you’re:

-

A first-time home buyer

-

Relocating from out of state

-

Buying near Wrightsville Beach, Carolina Beach, or Leland

-

Purchasing near Camp Lejeune

Pre-approval ensures your home search is focused, competitive, and stress-free.

Final Thoughts: Smart Buyers Get Pre-Approved First

Pre-qualification is a starting point — pre-approval is a strategy.

In today’s Wilmington real estate market, serious buyers get pre-approved before stepping into their first showing. It protects your time, your budget, and your negotiating position.

Thinking About Buying a Home in Wilmington or Southeastern NC?

If you’d like guidance on:

-

Trusted local lenders

-

Preparing for pre-approval

-

Navigating the Wilmington housing market

I’m happy to help you start the process the right way.

Ready to Start Your Home Search the Smart Way?

Before you tour homes or fall in love with a listing, make sure you’re positioned to win when the right home comes along. I’m happy to help you:

-

Connect with trusted local lenders in Wilmington & Southeastern NC

-

Understand the pre-approval process step by step

-

Build a smart buying strategy based on your real numbers, not estimates

Let’s Talk Before You Start Touring Homes

Chris Meek, Realtor®

Century 21 Vanguard – Wilmington, NC

📧 Email: Chris@ChrisMeekRealty.com

📱 Call/Text: 910-231-1553

🌐 Website: https://ChrisMeekRealty.com

👉 Whether you’re a first-time buyer, relocating to the Cape Fear region, or planning your next move, getting pre-approved first can save you time, money, and stress.

Reach out today — I’d be glad to help you get started the right way.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link